interskol-instrument.ru Overview

Overview

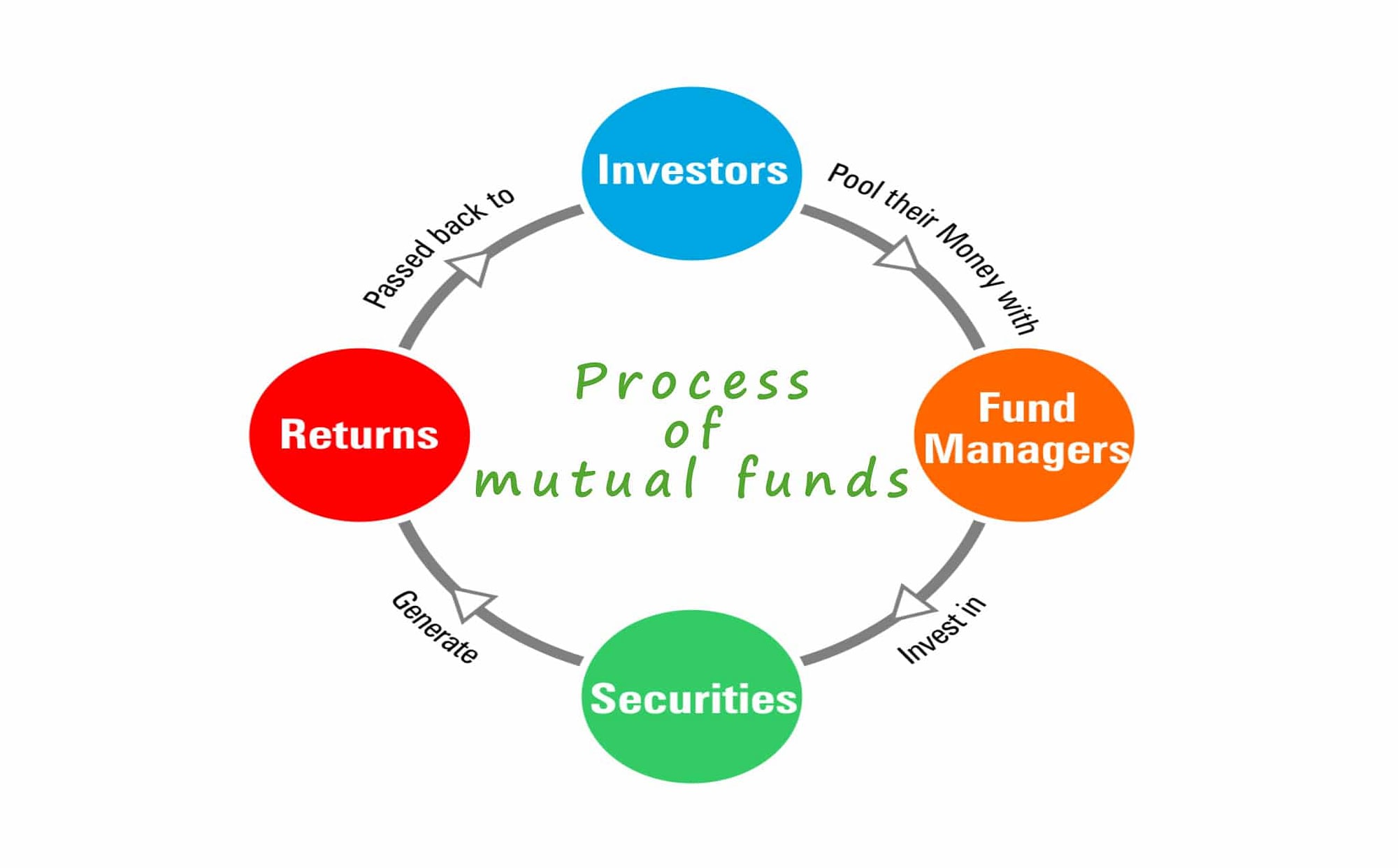

Are Mutual Funds A Good Idea

If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. Because mutual funds can invest in many different stocks or bonds, they give investors an easy way to diversify their portfolio. Icon of a euro. Low cost. Mutual funds are fine but often have higher management fees, some have loads, some have high turnover over and most have high buy in cost. As with other types of investment, investing in mutual funds involves various fees and expenses. Mutual funds are regulated by governmental bodies and are. Mutual funds are a good investment for some investors and can be an ideal addition to your overall portfolio. Due to the number of differences between various. And there's certainly risk in any investing but the mutual fund is very well established. It is highly regulated and there's very strong governance. Tadhg Young. Mutual funds give you an efficient way to diversify your portfolio, without having to select individual stocks or bonds. · They cover most major asset classes. Mutual funds use money from investors to purchase stocks, bonds and other assets. You can think of them as ready-made portfolios. Pros · Diversification — Mutual funds allow you to achieve a diversified portfolio quite easily. · Portfolio management — When you invest in a mutual fund, you. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. Because mutual funds can invest in many different stocks or bonds, they give investors an easy way to diversify their portfolio. Icon of a euro. Low cost. Mutual funds are fine but often have higher management fees, some have loads, some have high turnover over and most have high buy in cost. As with other types of investment, investing in mutual funds involves various fees and expenses. Mutual funds are regulated by governmental bodies and are. Mutual funds are a good investment for some investors and can be an ideal addition to your overall portfolio. Due to the number of differences between various. And there's certainly risk in any investing but the mutual fund is very well established. It is highly regulated and there's very strong governance. Tadhg Young. Mutual funds give you an efficient way to diversify your portfolio, without having to select individual stocks or bonds. · They cover most major asset classes. Mutual funds use money from investors to purchase stocks, bonds and other assets. You can think of them as ready-made portfolios. Pros · Diversification — Mutual funds allow you to achieve a diversified portfolio quite easily. · Portfolio management — When you invest in a mutual fund, you.

Still, the most important advantages mutual funds offer over other types of investments At least once a year, it's a good idea to review your investment plan. ETFs and mutual funds both come with built-in diversification. One fund could include tens, hundreds, or even thousands of individual stocks or bonds in a. And mutual funds or “asset management firms” are better if: And if you just can't decide, intern in both, and pick the winner for your full-time job. At least once a year, it's a good idea to review your investment plan. Because different investments grow at different paces, your current distribution of money. There are many reasons to choose mutual funds over stocks, such as diversification, convenience, and lower costs. Compare mutual funds vs. stocks here. Mutual funds are arguably one of the most popular investment options for retirement planning. According to the Investment Company Institute, % of US. By rebalancing regularly, you will continually be buying low and selling high. That means you sell the excellently performing investments (stock mutual funds in. Popular Fund Families · iShares · Fidelity Investments · Vanguard · T. Rowe Price · Charles Schwab · Principal Funds · AllianceBernstein · American Century Investments. Since not all investments perform well at the same time, holding a variety of investments with mutual funds may help offset the impact of poor performers, while. Become a better investor with investing ideas from our fund managers. These strategies highlight what we see as some of the opportunities to help maximize your. You can beat inflation with ease. You can generate good returns and build significant wealth in the long run. Your money is managed by professionals. As a pool of diversified assets managed by investment professionals, mutual funds offer distinct benefits for novice and seasoned investors. Here's another thing that target-date funds get right: They provide their investors with an element of advice, and they do so at a very low cost. The critics. Since not all investments perform well at the same time, holding a variety of investments with mutual funds may help offset the impact of poor performers, while. Chasing top-performing Mutual Funds can lead to neglecting market diversification. A fund that performs well due to a tech boom might falter if that sector. While it may feel pointless to start investing if you don't have much money, it can still be incredibly worthwhile. Think of it this way: few, if any, start. Like mutual funds, ETFs are SEC-registered investment com- panies that offer investors a way to pool their money in a fund that makes investments in stocks. Capital gains are a good thing. Unexpected tax bills are not. But the reality is that capital gains taxes are part of the normal (albeit unwelcome) 'price. Mutual funds offer investors the opportunity to group their money together and buy stocks, bonds and other investments “mutually” to invest in a common. There are multiple ways in which mutual funds can be categorized, for example, the way they are structured, the kind of securities they hold, their investment.

Ankr.Com

Ankr | followers on LinkedIn. The fastest, most reliable Web3 infrastructure. | Ankr is an all-in-one Web3 development hub that. Jump-start your research on Ankr Network (ANKR), with an automated score of 55% - Team 35% - Product 58% - GitHub 40% - Communication % - Brand/Buzz 40%. Ankr is the Blockchain infrastructure provider of the largest selection of Web3 APIs and has a disruptive Staking solution called Internet Bond. Ankr is a premier Web3 infrastructure company offering diverse products for building, earning, and gaming on blockchain technology. More about Ankr. The Weiss crypto rating of Ankr (ANKR) is D. Followers, 56 Following, 39 Posts - Ankr (@ankr) on Instagram: "The fastest, most reliable Web3 infrastructure ⚡️ ". @interskol-instrument.ru Compact library for interacting with Ankr APIs. ankr · ankrscan · blockchain · sdk. Ankr was founded in The company's main headquarters is located in Howard St. Suite San Francisco, California USoperates in the Software. Ankr is a Web3-native infrastructure platform that specializes in the fields of blockchain, development platform, and information technology. Ankr | followers on LinkedIn. The fastest, most reliable Web3 infrastructure. | Ankr is an all-in-one Web3 development hub that. Jump-start your research on Ankr Network (ANKR), with an automated score of 55% - Team 35% - Product 58% - GitHub 40% - Communication % - Brand/Buzz 40%. Ankr is the Blockchain infrastructure provider of the largest selection of Web3 APIs and has a disruptive Staking solution called Internet Bond. Ankr is a premier Web3 infrastructure company offering diverse products for building, earning, and gaming on blockchain technology. More about Ankr. The Weiss crypto rating of Ankr (ANKR) is D. Followers, 56 Following, 39 Posts - Ankr (@ankr) on Instagram: "The fastest, most reliable Web3 infrastructure ⚡️ ". @interskol-instrument.ru Compact library for interacting with Ankr APIs. ankr · ankrscan · blockchain · sdk. Ankr was founded in The company's main headquarters is located in Howard St. Suite San Francisco, California USoperates in the Software. Ankr is a Web3-native infrastructure platform that specializes in the fields of blockchain, development platform, and information technology.

We are excited to share that Ankr & Asphere have teamed up with Botanix Labs to play a pivotal role in creating the Spiderchain L2! The Spiderchain is a. Ankr provides Web3 infrastructure for easy, accessible and affordable deployment of blockchain nodes, API's, decentralized staking infrastructure and Layer. Ankr United States employs 59 employees. Reveal contacts of top Ankr managers and employees. - Page 2. Ankr API specs, API docs, OpenAPI support, SDKs, GraphQL, developer docs, CLI, IDE plugins, API pricing, developer experience, authentication. The price of Ankr Network (ANKR) is $ today with a hour trading volume of $12,, This represents a % price decline in. Get the desktop app for for Ankr on WebCatalog Desktop for Mac, Windows, Linux. Ankr Network. The Ankr Network is a decentralized network of nodes designed to provide flexible and cost-efficient connections to blockchains. It's built for. Get free blockchain RPC endpoints from Ankr and connect your wallet using Alchemy Chain Connect. Get the desktop app for for Ankr on WebCatalog Desktop for Mac, Windows, Linux. Ankr Talks · Join our team at Ankr while we travel across the world to speak about our products and how we are onboarding the next billion users to web3 with. Ankr, San Francisco, California. likes. Web3 Infrastructure for the Masses. Suggested forms Have questions or concerns about Ankr's products or services? Contact us for assistance. Get help with technical issues or bugs you've. Learn what Ankr Network (ANKR) cryptocurrency is and today's market price. Confidently invest in cryptocurrency with current and historical Ankr Network. Ankr Network Live Price Data. The live price of Ankr Network is $, with a total trading volume of $ 42, in the last 24 hours. The price of Ankr. Ankr is a Web3 development hub that specializes in blockchain infrastructure and decentralized application services. Use the CB Insights Platform to explore. Complete Ethereum library and wallet implementation in JavaScript. - interskol-instrument.ru at main · ethers-io/interskol-instrument.ru 44 votes, 20 comments. 18K subscribers in the Ankrofficial community. Ankr is powering the Web3 Ecosystem with a globally distributed node. The current price of Ankr (ANKR) is USD — it has fallen −% in the past 24 hours. Try placing this info into the context by checking out what coins. A free, fast, and reliable CDN for @interskol-instrument.ru interskol-instrument.ru" rel="noopener". Ankr is an all-in-one portal to build Kava dApps and power them with globally distributed nodes boasting % uptime and ultra-low latency. Ankr is a proud.

How To Write Posts On Linkedin

In this guide, we'll walk you through 10 essential steps to craft compelling LinkedIn posts that drive engagement and maximize your reach in Write posts that encourage engagement. Comments are LinkedIn gold. The more comments your post gets, the more users LinkedIn will show it to, and you'll quickly. Building an engaging LinkedIn post isn't just about sharing content—it's about creating value for your audience. The first line of your post is what decides if you have been able to capture the attention of your audience or not. That is what decides if the reader will. Always put your objective first, think about what you want to achieve on LinkedIn, whether this is attracting more clients or getting a new job. How to write effective LinkedIn Posts for Healthcare Professionals (HCPs) · 1. Understand Your Audience · 2. Diversify Your Content Mix · 3. Content Formats · 4. We've decided to launch our very own 'LinkedIn Post Type Guide', which we'll update regularly to inform you on new formats, changing platform standards or. Who can use this feature? · Go to your Pages super or content admin view. · Tap Start a post. · Write a draft with a minimum of 20 words. · Tap Rewrite with AI. The most important aspect of writing a LinkedIn article is choosing what you want to write about. That is because you need to balance three critical factors. In this guide, we'll walk you through 10 essential steps to craft compelling LinkedIn posts that drive engagement and maximize your reach in Write posts that encourage engagement. Comments are LinkedIn gold. The more comments your post gets, the more users LinkedIn will show it to, and you'll quickly. Building an engaging LinkedIn post isn't just about sharing content—it's about creating value for your audience. The first line of your post is what decides if you have been able to capture the attention of your audience or not. That is what decides if the reader will. Always put your objective first, think about what you want to achieve on LinkedIn, whether this is attracting more clients or getting a new job. How to write effective LinkedIn Posts for Healthcare Professionals (HCPs) · 1. Understand Your Audience · 2. Diversify Your Content Mix · 3. Content Formats · 4. We've decided to launch our very own 'LinkedIn Post Type Guide', which we'll update regularly to inform you on new formats, changing platform standards or. Who can use this feature? · Go to your Pages super or content admin view. · Tap Start a post. · Write a draft with a minimum of 20 words. · Tap Rewrite with AI. The most important aspect of writing a LinkedIn article is choosing what you want to write about. That is because you need to balance three critical factors.

1. Pick a Purpose—That Furthers Your Personal Brand Unlike other publications, which often have topic guidelines or restrictions, being able to post your own. In this comprehensive guide, we will explore the importance of previewing LinkedIn posts and provide you with the tools and knowledge to create attention-. In order to build your profile and presence on LinkedIn, you will need to create content (LinkedIn articles) which people in your network want to read, discuss. 4 tips to get ready for your first LinkedIn post · 1. Customise your feed. Customise your feed to follow hashtags or content creators who inspire you. · 2. We want to give you 12 strategies and examples for writing LinkedIn posts. LinkedIn is the most explosive writing platform on the internet right now. Use Start a post to share posts. · Use Photo to share images. · Use Video to share videos. · Use Write article to publish articles. In this comprehensive guide, we will explore the importance of previewing LinkedIn posts and provide you with the tools and knowledge to create attention-. Create posts with our AI-powered writing tool · Click Start a post at the top of your LinkedIn homepage. · In the share box, enter the main points that you want. Post about a problem or opportunity that's furrowing a senior leader's brow today, and tease a solution, and they may be on the phone to you tomorrow. Post about a problem or opportunity that's furrowing a senior leader's brow today, and tease a solution, and they may be on the phone to you tomorrow. Generate LinkedIn content in seconds with Hootsuite's free, AI-powered post maker. Become the next big influencer on the app with this handy tool. Below, you'll find 99+ content ideas that can make you a LinkedIn SUPERSTAR! Plus, we have included tons of examples of great LinkedIn posts to inspire you. I start by writing the main points I want to make. So if I am writing on five things you should know about followers on LinkedIn, I will write down those five. Post and share updates You can create a post and share updates using the share box at the top of the LinkedIn homepage. The character limit for a post is The experts say posting a minimum of 3 times a week should do it, I think that number is nearer 5. That's a lot of writing, a lot of ideas and it can seem. Generate engaging LinkedIn posts instantly. Enter your post topic. In a few words, describe the topic of your post. This will help create a post that is. There is a proven way to expand your LinkedIn influence through high-engaging techniques. If you follow the process, you can increase your engagement levels on. Your LinkedIn post needs a certain formatting. Your writing should be crisp and drive your reader like a flow. It should give them a feeling of accomplishment. For a LinkedIn ™ post to be devoured by your readers, the text needs to be airy and fluid. That is, try not to write paragraphs longer than sentences, and. How to schedule LinkedIn posts natively on Linkedin · 1. Log in to your LinkedIn account. · 2. Click on the 'Start a post button' and add images, videos, or text.

Top Insurance Companies In Minnesota

THAT'S WHY INSURANCE BROKERS OF MINNESOTA IS ASSOCIATED WITH OVER 50 TOP-RATED INSURANCE COMPANIES. Our goal is to provide you with the insurance you want. Headquartered in Minneapolis, MN, we are proud to serve Greater Minnesota with the absolute best customer service and comprehensive insurance solutions. Best Insurance Companies in Minneapolis, MN · Mutual of Omaha · Prudential Insurance · Minnesota Lawyers Mutual Insurance Company · Esurance · American Family. Whether you need help with choosing an insurance plan, or you need expert care – we've got you covered. Minnesota Township Mutuals Insurance Companies are authorized to write insurance SFM is the largest writer of workers compensation insurance in Minnesota. Popular startups, companies & organizations by highest day trend score: ; UnitedHealth Group Logo. UnitedHealth Group. —. ,, ; Patriot Insurance. Top 22 auto insurance companies in Minnesota · 1. Baxter Insurance Group · 2. Richfield State Insurance · 3. Mark Pietia - North Star Insurance · 4. Reliable. Our Insurance Division oversees insurance companies operating in Minnesota back to top. Top Insurance Companies in Minneapolis-St. Paul, MN · Filter Companies · Travelers · State Farm · Aon · Progressive Insurance · Thrivent · The Hartford. THAT'S WHY INSURANCE BROKERS OF MINNESOTA IS ASSOCIATED WITH OVER 50 TOP-RATED INSURANCE COMPANIES. Our goal is to provide you with the insurance you want. Headquartered in Minneapolis, MN, we are proud to serve Greater Minnesota with the absolute best customer service and comprehensive insurance solutions. Best Insurance Companies in Minneapolis, MN · Mutual of Omaha · Prudential Insurance · Minnesota Lawyers Mutual Insurance Company · Esurance · American Family. Whether you need help with choosing an insurance plan, or you need expert care – we've got you covered. Minnesota Township Mutuals Insurance Companies are authorized to write insurance SFM is the largest writer of workers compensation insurance in Minnesota. Popular startups, companies & organizations by highest day trend score: ; UnitedHealth Group Logo. UnitedHealth Group. —. ,, ; Patriot Insurance. Top 22 auto insurance companies in Minnesota · 1. Baxter Insurance Group · 2. Richfield State Insurance · 3. Mark Pietia - North Star Insurance · 4. Reliable. Our Insurance Division oversees insurance companies operating in Minnesota back to top. Top Insurance Companies in Minneapolis-St. Paul, MN · Filter Companies · Travelers · State Farm · Aon · Progressive Insurance · Thrivent · The Hartford.

Best Life Insurance Companies in Minneapolis, MN · Our Recommended Top 18 · Providers · Kriener Insurance interskol-instrument.ru · interskol-instrument.ru Concierge Service Expertise. Homeowners insurance rates in Minnesota differ depending on which insurance company you use. Liberty Mutual provides the most affordable homeowners insurance in. Custom insurance plans that fit your lifestyle. We've partnered with 20 top insurance companies to provide premier coverage &outstanding claims service. Independent car insurance agents consider your needs and driving habits to find the best coverage. They aren't tied to a specific insurance company, so they. State Farm and USAA shared the top spot in our ranking of best universal life insurance companies in Minnesota. Nationwide and MassMutual tied for third place. Top Minnesota insurer. We insure more Minnesota businesses for work comp than CompOnline is a registered trademark of SFM Mutual Insurance Company. What are the best home and auto insurance companies in Minnesota? ; Travelers, A++, ; State Farm, A++, ; Nationwide, A+, ; Allstate, A+, Best Insurance Agents in Minnesota ; Stephanie Fetzer · Reviews · Hyland Greens Drive, Suite , Minneapolis, MN · ; Julia Skuibida. Insurance Companies · AAA Insurance · Acuity Insurance · Allied Property and Casualty Insurance Company · American Collectors Insurance · American Modern Insurance. I've had 2 roofing companies say they'd patch, they'd replace. The roofer's said, "USAA is the best, Liberty Mutual is very good, State Farm and. Associated Financial Group LLC - Minneapolis, MN. Minnesota, Minnetonka ; Brokers And Consultants - Minneapolis, MN. Minnesota, Eden Prairie. Health Insurance, BCBS MN, Medica, HealthPartners, PreferredOne, Ucare, Humana, Assurant. Dental Insurance Carriers in Minnesota. Ameritas Life Insurance Corp. Golden Rule Insurance Company · Humana · MetLife · Medicare Insurance Providers in. Best Minnesota Independent Insurance Agents. Insurance Agency Directory > Minnesota For Insurance Companies. Become a Recommended Company · Trustedchoice. Golden Valley, MN () or interskol-instrument.ru Time Insurance Company (formerly Fortis Insurance Company). West Michigan. The cheapest car insurance companies in Minnesota ; $1, · $1, · $1, · $2, Insurance Companies and Networks ; Blue Plus logo. or Blue Plus networks & provider directories. HealthPartners logo. or. AM Best affirms Securian Financial's A+ (Superior) rating and stable outlook (article with video) AM Best affirmed Securian Financial's insurance financial. The best insurance companies to work for in Minnesota are OneBeacon, Allianz Life, Prime Therapeutics and more. Compare the top big and small insurance. Ameriprise Financial (Investment Advice): 5, · Wells Fargo Home Mortgage (Real Estate Credit): 3, · Blue Cross & Blue Shield of Minnesota (Insurance.

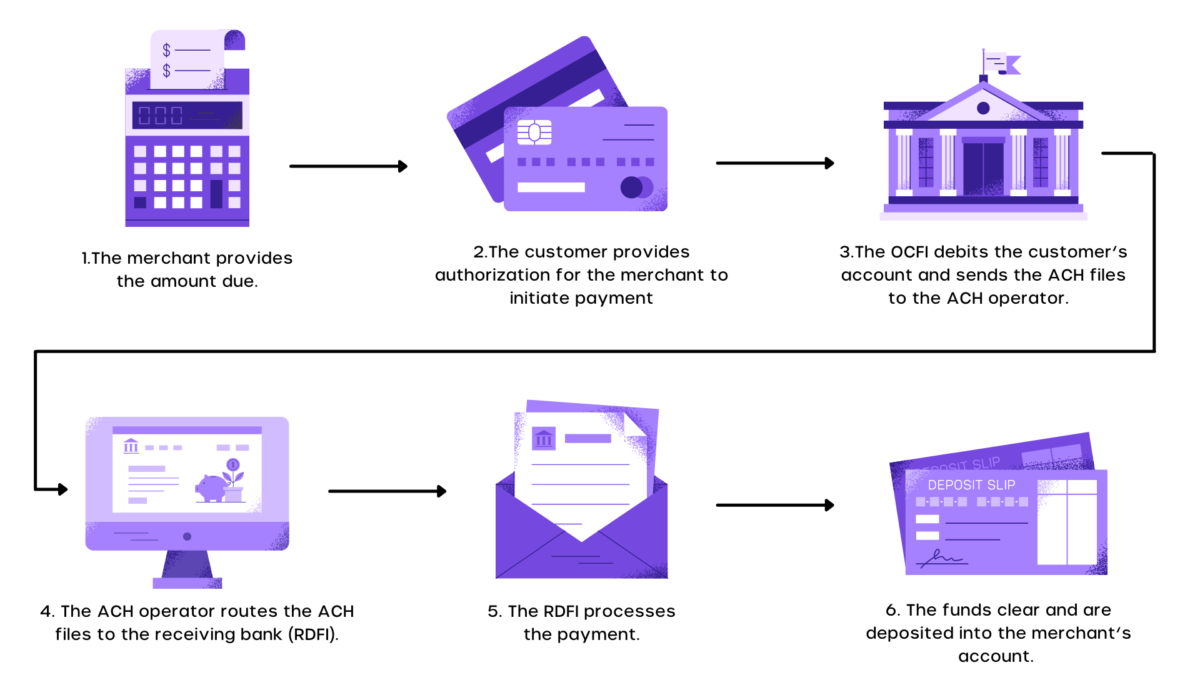

What Is An Ach Transfer In Banking

What are ACH payments? An ACH payment is an electronic transfer between bank accounts that is handled by the ACH network. This payment can be to or from a. Direct payment via ACH withdrawal takes funds from accounts via either credit or debit and is used for things like paying bills. ACH payments make the payment. The ACH system is a way to transfer money between bank accounts, rather than going through card networks or using wire transfers, paper checks, or cash. The. When you transfer money from one bank account to another within the United States, the transaction will be processed via the ACH, or Automated Clearing. An ACH transfer is an electronic money transfer from one financial institution to another, processed through the Automated Clearing House Network. Thousands of. What is an ACH transfer? ACH transfers move money between banks electronically through the Automated Clearing House network. More and more businesses are. What is ACH in banking? In banking, ACH payments (a.k.a. ACH transfers) are payments made directly from one bank account to another. These transfers are. The Reserve Banks and EPN rely on each other to process interoperator ACH payments--that is, payments in which the originating depository financial institution. Bank of America's Automated Clearing House (ACH) is an electronic payment delivery system that allows you to pay or collect funds electronically through the. What are ACH payments? An ACH payment is an electronic transfer between bank accounts that is handled by the ACH network. This payment can be to or from a. Direct payment via ACH withdrawal takes funds from accounts via either credit or debit and is used for things like paying bills. ACH payments make the payment. The ACH system is a way to transfer money between bank accounts, rather than going through card networks or using wire transfers, paper checks, or cash. The. When you transfer money from one bank account to another within the United States, the transaction will be processed via the ACH, or Automated Clearing. An ACH transfer is an electronic money transfer from one financial institution to another, processed through the Automated Clearing House Network. Thousands of. What is an ACH transfer? ACH transfers move money between banks electronically through the Automated Clearing House network. More and more businesses are. What is ACH in banking? In banking, ACH payments (a.k.a. ACH transfers) are payments made directly from one bank account to another. These transfers are. The Reserve Banks and EPN rely on each other to process interoperator ACH payments--that is, payments in which the originating depository financial institution. Bank of America's Automated Clearing House (ACH) is an electronic payment delivery system that allows you to pay or collect funds electronically through the.

ACH stands for Automated Clearing House, an online network for processing transactions between banks and other financial institutions. Every time your salary is. An ACH payment is an electronic payment made from one bank to another. An employer that uses direct deposit authorizes payments from its bank account to its. ACH stands for Automated Clearing House, which powers billions of electronic money transfers. Learn how it works and differs from wire transfer. Direct payment via ACH withdrawal takes funds from accounts via either credit or debit and is used for things like paying bills. ACH payments make the payment. An ACH transfer is a payment made between bank accounts through the ACH (Automated Clearing House) network. An ACH transfer is one of the most popular types of. ACH transfer, also known as Automated Clearing House transfer, is an electronic payment system that allows funds to be transferred between bank accounts in. ACH payments are electronic payments between banks or credit unions. Direct deposits are transfers into an account, typically used for things like payroll. ACH (Automated Clearing House) is a payment processing network that's used to send money electronically between banks in the United States. It allows for. What is ACH bank transfer? ACH stands for Automated Clearing House. In the US, ACH payments are managed and overseen by Nacha¹. ACH bank transfers cover. ACH payments through Invoice2go are free regardless of the payment amount. This makes ACH transfers (called Direct transfer in the app), ideal for big invoices. The most common types of ACH direct deposits include salary payment, tax returns, and government benefits. ACH transfers have made paper checks obsolete. In. Also known as direct debit, EFT, electronic bank transfer and eCheck, these types of payments move on the ACH Network – a payment system that reaches all U.S. An ACH direct payment delivers funds into a bank account as credit. A direct deposit covers all kinds of deposit payments from businesses or government to a. ACH (Automated Clearing House) payments are electronic transfers and direct payment between bank accounts within the United States. · They facilitate various. The ACH system is an electronic bank-to-bank payment in the US that allows you to transfer money from one bank to another. ACH makes it easier to send money. ACH payments save time, money, and reduce stress. ACH bank transfers through Square are a simple, secure, and cost-effective way to get paid from anywhere. There are two ways to send an ACH transfer from your bank after you've started your payment in E-File and have a unique Identification Number for your. ACH stands for Automated Clearing House, which powers billions of electronic money transfers. Learn how it works and differs from wire transfer. An example of an ACH payment is the direct deposit of an employee's salary. In this scenario, an employer sends the payroll information to their bank, which. When a customer pays you through ACH, that electronic funds transfer (EFT) will show up in your bank account as a direct deposit or direct payment. However, ACH.

Social Security Disability Versus Social Security Retirement

Learn the difference between SSDI and SSI · SSDI is tied to your work history. It pays benefits to you and certain members of your family if you: · SSI does not. We generally advise our clients to apply for disability benefits before taking a retirement benefit because if you opt for a reduced retirement amount while. • Other income does NOT affect benefits. (Except wages may affect benefits under full retirement age or disability benefits). • Where you live or who lives. Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work. In fact, SSA plays a role in our lives directly. Social Security amounts automatically adjust for the cost of living and/or inflation, while pension plans have to deliberately increase future benefits. Last. SSI = Requires being low income/resources. Can receive benefits at any age if disabled or age 65+ regardless of disability. Retirement benefits. Compared to SSDI or long-term disability plans, the elimination period is much shorter – typically two weeks. While STD payments don't replace all of your wages. SSI (Supplemental Security Income) and SSDI (Social Security Disability Insurance) are two completely different governmental programs. However, they are both. Differences · The key difference is the non-medical eligibility criteria. SSI is based on need. SSDI is based on contributions by employees and employers to the. Learn the difference between SSDI and SSI · SSDI is tied to your work history. It pays benefits to you and certain members of your family if you: · SSI does not. We generally advise our clients to apply for disability benefits before taking a retirement benefit because if you opt for a reduced retirement amount while. • Other income does NOT affect benefits. (Except wages may affect benefits under full retirement age or disability benefits). • Where you live or who lives. Unlike Social Security benefits, SSI benefits are not based on your prior work or a family member's prior work. In fact, SSA plays a role in our lives directly. Social Security amounts automatically adjust for the cost of living and/or inflation, while pension plans have to deliberately increase future benefits. Last. SSI = Requires being low income/resources. Can receive benefits at any age if disabled or age 65+ regardless of disability. Retirement benefits. Compared to SSDI or long-term disability plans, the elimination period is much shorter – typically two weeks. While STD payments don't replace all of your wages. SSI (Supplemental Security Income) and SSDI (Social Security Disability Insurance) are two completely different governmental programs. However, they are both. Differences · The key difference is the non-medical eligibility criteria. SSI is based on need. SSDI is based on contributions by employees and employers to the.

Although Social Security Disability Insurance (SSDI) and retirement benefits are both paid from the Social Security Fund, the two benefits are provided to. Yes, you can receive Social Security disability benefits (SSDI) and Social Security retirement benefits at the same time under certain circumstances, with your. The main difference between SSDI (Social Security Disability Insurance) and SSI (Supplemental Security Income) is the fact that SSDI is available to workers. The Social Security Administration (SSA) administers two programs that provide benefits based on disability: the Social Security disability insurance program . Social Security doesn't provide temporary or partial disability benefits, like workers' compensation or veterans' benefits do. Are LTD and SSDI benefits funded differently? Yes. Long term disability is a privately funded benefit, and Social Security disability benefits are a. As a matter of general rule, the amount you expect to receive from Social Security Disability Insurance is usually slightly less than what you expect to. as a full, unreduced retirement benefit. If you get. Social Security disability benefits when you reach full retirement age, we convert those benefits to. SSI is a supplement to Social Security benefits at age 65 and older for those with low Social Security retirement benefits. SSDI is for those. SSDI is for workers and certain family members if they worked long enough and recently enough to be eligible for benefits. SSI is for people who are 65 or older. To receive disability benefits, a person must meet the definition of disability under the Social Security Act (Act). A person is disabled under the Act if they. Comparison of the SSDI and SSI Disability Programs ; Is a State Supplemental Payment provided? There is no state supplemental payment with the SSDI program. Many. SSI vs. SSDI: What's the Difference? SSI and SSDI are programs administered by the Social Security Administration (SSA) to provide income to people who meet. Your Social Security Disability benefits will automatically convert into regular Social Security retirement benefits when you reach your full retirement. While retirement benefits impact your SSI benefits, these private funds usually do not change your SSDI amount. If your pension or retirement plans come from an. This publication, Understanding the Benefits, explains the basics of the Social Security retirement, disability, and survivors insurance programs. Page 6. 2. Your Social Security Disability benefits will automatically convert into regular Social Security retirement benefits when you reach your full retirement. SSDI is a type of “insurance” for people who pay Social Security taxes. SSI is based on the financial needs of a person who is disabled. While SSDI eligibility. Social Security Disability Insurance pays benefits to you and certain members of your family if you are "insured," meaning that you worked long enough and paid. As a matter of general rule, the amount you expect to receive from Social Security Disability Insurance is usually slightly less than what you expect to.

Do Credit Cards Close On Their Own

We've written frequently about how closing accounts isn't necessarily good for your credit score, but once an account is closed it can't be used to accumulate. “Opening the door to a credit card while they're still at home is a great idea. When children get to college they will be bombarded with credit card offers, so. Will I be notified before my account is closed? Not necessarily. Credit card companies aren't required to give you any notice that they're closing your account. Closing unused cards may also have a negative impact on your credit score. Closing your cards will shorten the length of your credit history, which may result. Credit card issuers can close your account due to what's known as "inactivity," meaning you haven't used the card in a certain amount of time. Closing a credit card can negatively impact your credit utilization ratio, which is the second most important factor in determining your FICO credit score. The. Will Closing a Card Damage My Credit History? Not really. A closed account will remain on your reports for up to seven years (if negative) or around 10 years . All in one solution. Our consumer and commercial platforms include everything you need to launch a credit card quickly. However, a closed card will stay on your credit report for up to 10 years, so you'll still benefit from your closed account if you have a good history of on-. We've written frequently about how closing accounts isn't necessarily good for your credit score, but once an account is closed it can't be used to accumulate. “Opening the door to a credit card while they're still at home is a great idea. When children get to college they will be bombarded with credit card offers, so. Will I be notified before my account is closed? Not necessarily. Credit card companies aren't required to give you any notice that they're closing your account. Closing unused cards may also have a negative impact on your credit score. Closing your cards will shorten the length of your credit history, which may result. Credit card issuers can close your account due to what's known as "inactivity," meaning you haven't used the card in a certain amount of time. Closing a credit card can negatively impact your credit utilization ratio, which is the second most important factor in determining your FICO credit score. The. Will Closing a Card Damage My Credit History? Not really. A closed account will remain on your reports for up to seven years (if negative) or around 10 years . All in one solution. Our consumer and commercial platforms include everything you need to launch a credit card quickly. However, a closed card will stay on your credit report for up to 10 years, so you'll still benefit from your closed account if you have a good history of on-.

So, by closing an old or unused card, you are essentially wiping away some of your available credit and there by increasing your credit utilization ratio. It's. If you are considering a large new purchase that requires a loan and a credit check – like buying a home or a car – then do not close your old credit card. The short answer: we never recommend closing old or unused credit cards because this rarely helps your FICO score. Here are some basic guidelines for credit. Yes, cards can be closed due to inactivity. Lenders have different policies on this. Some will close you down around the 1 year mark, others will let you go a. The lender may close your account when your card remains unused for months or even years. And once your account is closed, your credit. If your credit card account becomes inactive for an extended period, a lender may close it on your behalf. Learn more about inactive credit cards with help. I pay as I go vs. when the bill comes in at the end. 15% ARP, % cash back monthly payment: $1, pay-off time: 1 month interest. Closing an account may lead to a drop in your total available credit, which ultimately affects your credit score negatively. If you have credit card debt and stop making payments on your credit cards, the accounts will be suspended. How will you rent a car, book a hotel room, or make. Closing credit cards does reduce your credit score. Doing this at the wrong your own terms? Take our quiz and find out: Take the Quiz. Here's How to. Closing a new account will have less of an impact. To keep your credit score in good standing, it's important to remember to stick with a low balance that can. While authorized users receive their own credit card, they do not have all the same permissions as the primary account holder. For example, authorized users. People close credit cards for many reasons, including excessive spending, avoiding high-interest rates, or protection from identity theft. · Closing credit card. Credit cards give you access to a revolving line of credit, the amount of which is capped by the card issuer. When you use a card to make a purchase, you are. Cutting up your credit card does not close the account, however, and it probably won't even be possible if you have a metal credit card. With that in mind. Although secured cards typically have low credit limits, closing one will still decrease the amount of credit you have available. This will cause your credit. Paying only the minimum on a maxed-out credit card will not reduce the balance quickly. You'll end up with hefty interest payments, and it will take years to. Before you close a credit card, try to ensure that it's not carrying a balance. Canceling the credit card won't magically erase your debt, and your balance will. Managing the financial affairs of a deceased loved one can be challenging, but closing their credit cards doesn't have to be. Get started here. Although secured cards typically have low credit limits, closing one will still decrease the amount of credit you have available. This will cause your credit.

How Much Does 1 Square Of Shingles Cost

The average cost to install shingles ranges from $4 to $30 per interskol-instrument.ru, depending on the material. Asphalt shingles cost the least, while slate and copper. Calculate the Weight of Your Shingles · How Much Do Shingles Weigh? · How Many Squares of Shingles Fit in a Dumpster? · Shingle Weight FAQs · How much does a bundle. So in Boston, Massachusetts and the surrounding suburbs like Framingham or Braintree, the cost of a square of roofing is between $ and $ A large part of the quote will be materials used per square, meaning that every square feet will add to the final cost of your new roof. The incremental. Metal roofing and cedar shake materials are commonly the most expensive roofing materials, both costing between $13 and $30 per sq. ft. Although a much higher. The cost of installing this type of roofing in Indianapolis is about $5 per square foot, which is within the average range for most places. With these estimates. Our local stores do not honor online pricing. Prices and availability of Charcoal 3-tab Roof Shingles (sq ft per Bundle) · Shop the Collection. Cost by Roofing Material There are several types of roof materials to choose from. Asphalt shingles cost as low as $ per square foot, while copper roofing. The average labor cost for professional shingle installation ranges from $ to $ per square foot or $ to $ per square, but this can vary depending. The average cost to install shingles ranges from $4 to $30 per interskol-instrument.ru, depending on the material. Asphalt shingles cost the least, while slate and copper. Calculate the Weight of Your Shingles · How Much Do Shingles Weigh? · How Many Squares of Shingles Fit in a Dumpster? · Shingle Weight FAQs · How much does a bundle. So in Boston, Massachusetts and the surrounding suburbs like Framingham or Braintree, the cost of a square of roofing is between $ and $ A large part of the quote will be materials used per square, meaning that every square feet will add to the final cost of your new roof. The incremental. Metal roofing and cedar shake materials are commonly the most expensive roofing materials, both costing between $13 and $30 per sq. ft. Although a much higher. The cost of installing this type of roofing in Indianapolis is about $5 per square foot, which is within the average range for most places. With these estimates. Our local stores do not honor online pricing. Prices and availability of Charcoal 3-tab Roof Shingles (sq ft per Bundle) · Shop the Collection. Cost by Roofing Material There are several types of roof materials to choose from. Asphalt shingles cost as low as $ per square foot, while copper roofing. The average labor cost for professional shingle installation ranges from $ to $ per square foot or $ to $ per square, but this can vary depending.

But be careful — not all shingle brands are packaged three bundles to a square! Read the label carefully, as some brands need a bit more than three bundles to. If you were to purchase a bundle, it would install up to 1/3 of a square or about square feet of roofing area. See our roof shingle cost chart below to see. Shingles Roof Cost Estimate · Asphalt Shingles: The most common choice, asphalt shingles, can range from $3 to $7 per square foot. · Wood Shingles: If you'. But be careful — not all shingle brands are packaged three bundles to a square! Read the label carefully, as some brands need a bit more than three bundles to. Get free shipping on qualified Roof Shingles products or Buy Online Pick Up in Store today in the Building Materials Department. To determine how many squares are on the roof, you need to calculate the total square footage and divide it by The measurement does not change whether you. One of the biggest expenses in roof replacement is the material. Basic three-tab asphalt shingles are the least expensive roofing material. A square of the. The most expensive roofing material is metal, with an average cost of $ per square foot. Despite its higher cost, opting for metal roofing offers a host of. In , the average roof replacement cost for an asphalt shingle roof was $10,*. A new roof is a significant financial investment and roof costs can vary. 30 years shingles run about $75–80 per square (three bundles). Add in underlayment, roof jacks, flashing, drip edge, nails, and so forth. There. The basic cost to Install a Asphalt Shingle Roof is $ - $ per square foot in The cost estimate does NOT include: Costs for removing, relocating. If you do the math, the shingles for an architectural roof replacement will cost $3, The shingles for a 3 tab roof will cost about $2, If you're. The cost of a bundle of shingles varies depending on the shingle type and manufacturer, however on average asphalt shingles will range from $ dollars. The cost of a bundle of shingles varies depending on the shingle type and manufacturer, however on average asphalt shingles will range from $ dollars. Size of roof, which determines number of shingle roofing squares (1 square = ² ft) needed to cover; How many stories your house has; Style and. The price of standard asphalt shingles falls between $ – $ per square foot. To give you an example, the average roof in Chicago is approximately How many shingles are in a bundle and what area does it cover? Each bundle Keep up-to-date on all future manufacturer price increases. View price. The average cost of a roof replacement installing these shingles is between $11, and $17, in Florida. You are sure to find something unique to your liking. *The average cost of materials for a standard 3-tab shingle is about $ per square, including shingles, felt paper, and nails.

Good Credit Cards For New Grads

If you don't want to deal with bonus categories and are just looking for a great overall rate, check out Capital One Quicksilver Student Cash Rewards Credit. Best Credit Cards Perks For Fresh Graduates · Up to $ cashback or 8% cashback on foreign currency transactions and online/contactless mobile transactions · Up. Build credit, earn rewards and pay for everyday purchases with a no- or low-fee student credit card. New to CIBC? As a newcomer, choose from a variety of credit cards and start building your credit history in Canada with the Scotiabank StartRight® Program. PNC Cash Rewards® Visa® Credit Card · You'll receive a $ Bonus after you make $1, or more in purchases during the first 3 months following account opening. We recommend these cards from our partners. CK Editors' Tips††: Student credit cards may offer rewards and other features to help you start your credit journey. If you're a post-secondary student, you may be eligible for a student credit card. Student credit cards help you build your Canadian credit history. These cards allow you to use your time in college to build up credit so that once you graduate you'll have a good credit foundation. Bank of America® Travel Rewards Credit Card for Students: Best feature: Travel rewards for students. Capital One Quicksilver Student Cash Rewards Credit Card. If you don't want to deal with bonus categories and are just looking for a great overall rate, check out Capital One Quicksilver Student Cash Rewards Credit. Best Credit Cards Perks For Fresh Graduates · Up to $ cashback or 8% cashback on foreign currency transactions and online/contactless mobile transactions · Up. Build credit, earn rewards and pay for everyday purchases with a no- or low-fee student credit card. New to CIBC? As a newcomer, choose from a variety of credit cards and start building your credit history in Canada with the Scotiabank StartRight® Program. PNC Cash Rewards® Visa® Credit Card · You'll receive a $ Bonus after you make $1, or more in purchases during the first 3 months following account opening. We recommend these cards from our partners. CK Editors' Tips††: Student credit cards may offer rewards and other features to help you start your credit journey. If you're a post-secondary student, you may be eligible for a student credit card. Student credit cards help you build your Canadian credit history. These cards allow you to use your time in college to build up credit so that once you graduate you'll have a good credit foundation. Bank of America® Travel Rewards Credit Card for Students: Best feature: Travel rewards for students. Capital One Quicksilver Student Cash Rewards Credit Card.

Best Credit Cards Perks For Fresh Graduates · Up to $ cashback or 8% cashback on foreign currency transactions and online/contactless mobile transactions · Up. A no annual fee student credit card from BMO is a good way to start building a healthy credit history. Plus you can earn rewards every time you spend. Choose the best credit card · Grace period is the time between the date of purchase and the date interest begins accruing. · Annual fees are charged by many. Student credit cards are designed for undergraduate, graduate and nontraditional student borrowers looking to establish good credit habits while pursuing their. CIBC's student cards can help you build your credit history and collect rewards on purchases made on select cards. Apply for the best CIBC student card for. new residents to choose from. What's the difference between a good credit card provider and a great one? Which benefits will prove to be the most helpful. However, Chase Freedom Rise℠ is likely a card for people new to credit cards, including students, that offers % cash back on all purchases. New Freedom Rise. After you graduate, “real life” begins. In the real world, you need a The best way to use your new credit card responsibly is to: Never spend more. Chase does not offer student credit cards. However, Chase Freedom Rise℠ is likely a card for people new to credit cards, including students, that offers %. 1. Scotiabank SCENE+ Visa Card – Best student credit card for entertainment and restaurants. Scotiabank SCENE+ Visa Card. NerdWallet named SavorOne Rewards for Students the best credit card for college students as part of its Best-Of Awards. The SavorOne Student card was. Explore student credit cards ; NEW CARD MEMBER OFFER ; Earn a one-time $50 cash bonus once you spend $ on purchases within 3 months from account opening. The American Express Gold Rewards Card currently offers the best signup bonus among all credit cards. Based on our analysis, the best all-around credit card for students is the Capital One Quicksilver Rewards for Students card. Is a student credit card worth it? 3. Capital One Quicksilver Rewards for Students Credit Card The Capital One Quicksilver Rewards for Students card offers new cardholders a $ cash bonus. In America, building a good credit history is the foundation of financial management. Use credit cards responsibly to help strengthen your credit score. The Petal® 2 "Cash Back, No Fees" Visa® Credit Card is a quality card for individuals with no or fair credit history, and it also features rewards and no fees. Bank of America® credit cards for students are designed to help students build credit and assist in establishing good credit habits that can be used to. If you're just starting to establish credit or have a low score that you're trying to improve, then the Capital One Guaranteed Secured Mastercard may be a great.

Is Lifelock Really Worth It

I like the fact that it can actually monitor my bank and charge accounts with site credentials and get actual balance information. The free credit report was a. It's worth noting that a LifeLock membership doesn't mean you'll need to be checking on it frequently; you let LifeLock tell you when situations arise. It's. It is a fairly good identity theft protection service offering a wide variety of different tools and services that promote identity theft protection. LifeLock Junior is an add-on plan that any parent can pay for to give their minor ID theft coverage. Find out if it's really worth; read our review here! It really is free! · Our easy-to-use app puts control in your hands · Lock or freeze. With data breaches at Target, Home Depot and most recently Anthem, maybe it's no surprise that LifeLock reported record quarterly revenue on. LifeLock reviews ; 5 Stars ; 4 Stars 15 ; 3 Stars 10 ; 2 Stars 10 ; 1 Star ° LifeLock makes identity theft protection easy. Start your protection now Is identity theft protection worth it in , really? No one can stop. If you're worried about being locked into a subscription with LifeLock, it's worth noting that LifeLock has a great money-back guarantees, with a full 60 days. I like the fact that it can actually monitor my bank and charge accounts with site credentials and get actual balance information. The free credit report was a. It's worth noting that a LifeLock membership doesn't mean you'll need to be checking on it frequently; you let LifeLock tell you when situations arise. It's. It is a fairly good identity theft protection service offering a wide variety of different tools and services that promote identity theft protection. LifeLock Junior is an add-on plan that any parent can pay for to give their minor ID theft coverage. Find out if it's really worth; read our review here! It really is free! · Our easy-to-use app puts control in your hands · Lock or freeze. With data breaches at Target, Home Depot and most recently Anthem, maybe it's no surprise that LifeLock reported record quarterly revenue on. LifeLock reviews ; 5 Stars ; 4 Stars 15 ; 3 Stars 10 ; 2 Stars 10 ; 1 Star ° LifeLock makes identity theft protection easy. Start your protection now Is identity theft protection worth it in , really? No one can stop. If you're worried about being locked into a subscription with LifeLock, it's worth noting that LifeLock has a great money-back guarantees, with a full 60 days.

LifeLock — now NortonLifeLock — is one of our favorite identity theft protection services on the market today. When we reviewed NortonLifeLock recently. Identity Theft Protection Worth Having! Because the best protection doesn't just monitor. It helps you take your life back. Protect Yourself. Is Credit Karma Worth Signing Up For? Credit Karma offers basic credit This service really couldn't be easier to use. As mentioned earlier, there's. In fact, with LifeLock Advantage™ and LifeLock Ultimate Plus™, we can help Are They Really Worth $? My Unbiased Tieks Review · tieks. Living Room. The plan for one or two adults may be worth it for you and/or a spouse who needs significant fraud protection and has high-value accounts and assets. Otherwise. The bottom line is that LifeLock is not a scam, it's just that you can do a lot of what they do for free. LifeLock might be worth. LifeLock by Norton Is identity theft protection worth it in , really? No one can stop. LifeLock: Starts at $/month; IDShield: Starts at $/month While ID Shield offers an all-in-one identity theft protection plan, it really. This app is truly proactive when it comes to safety. This is the first time in the 20+ years of using a tech service that it actually worked better than. Is it worth the money? adaptability: Could this work for me over time? usage: Is its usage intuitive? Is it professional in appearance and function? IYM. There are absolutely no true benefits of lifelock identity theft. Lifelock IS a waste of money. Be aware of fraud and scam practices. It is worth every penny. I get email and text alerts whenever anyone Customer service:(I actually used to recomend LIfelock!) when you need them. For trusted quality identity theft protection, LifeLock offers competitive packages and services to protect all customers. Customers can find basic or premium. It doesn't really dismantle sites that sell stolen IDs LifeLock's TV ad says it's "there" for you if it finds your data's for sale. Lifelock Review- Is It Really Worth It in Image. Lifelock provides a valuable service. There's no doubt about that. The question "Is Lifelock work it?" is really a decision of value. Time. It's worth considering that Discover is only available to card-holders, while NortonLifeLock's premier plan is one of the most expensive (but comprehensive). Do you agree with LifeLock's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews out of. Top LifeLock Reviews LifeLock is truly fantastic. I've been with them for more than 5 years. They do an amazing job protecting our personal information. I'm. Thanks LifeLock. With that I would recommend this product for anyone who wants to protect their data and wants piece of mind if something does happen you can.